Master Investment Research Through Hands-On Learning

Join our comprehensive program starting September 2025. Learn real-world financial analysis techniques from industry professionals who've spent years navigating Canadian and international markets.

What You'll Actually Learn

We focus on practical skills that matter in real investment scenarios. No fluff, just techniques you can use immediately.

Financial Statement Deep Dives

You'll work with actual company reports, learning to spot red flags and identify genuine value. We use real Canadian companies as case studies, so you understand how to read between the lines of earnings reports and balance sheets.

Market Analysis Frameworks

Build systematic approaches to evaluating investment opportunities. From sector comparisons to risk assessment models, you'll develop tools that help you make informed decisions rather than educated guesses.

Research Documentation

Learn how to document your analysis process effectively. This isn't about fancy presentations – it's about creating clear, actionable research that you can reference months later when making portfolio decisions.

How the Program Works

Eight months of focused learning, starting with fundamentals and building toward complex analysis projects.

Foundation Phase (Months 1-2)

Master financial statement basics and accounting principles. You'll analyze three different Canadian companies to understand how numbers translate into business reality.

September - October 2025Analysis Techniques (Months 3-4)

Develop valuation skills using discounted cash flow models and comparative analysis. Work on sector-specific research projects that mirror real investment firm processes.

November - December 2025Advanced Research (Months 5-6)

Tackle complex scenarios including distressed companies, growth stocks, and international investments. Build comprehensive research reports from scratch.

January - February 2026Portfolio Application (Months 7-8)

Apply everything you've learned to create and defend investment recommendations. Present your research to experienced professionals for feedback.

March - April 2026Learn From People Who've Done This Work

Our instructors bring decades of combined experience from Canadian financial institutions and investment firms.

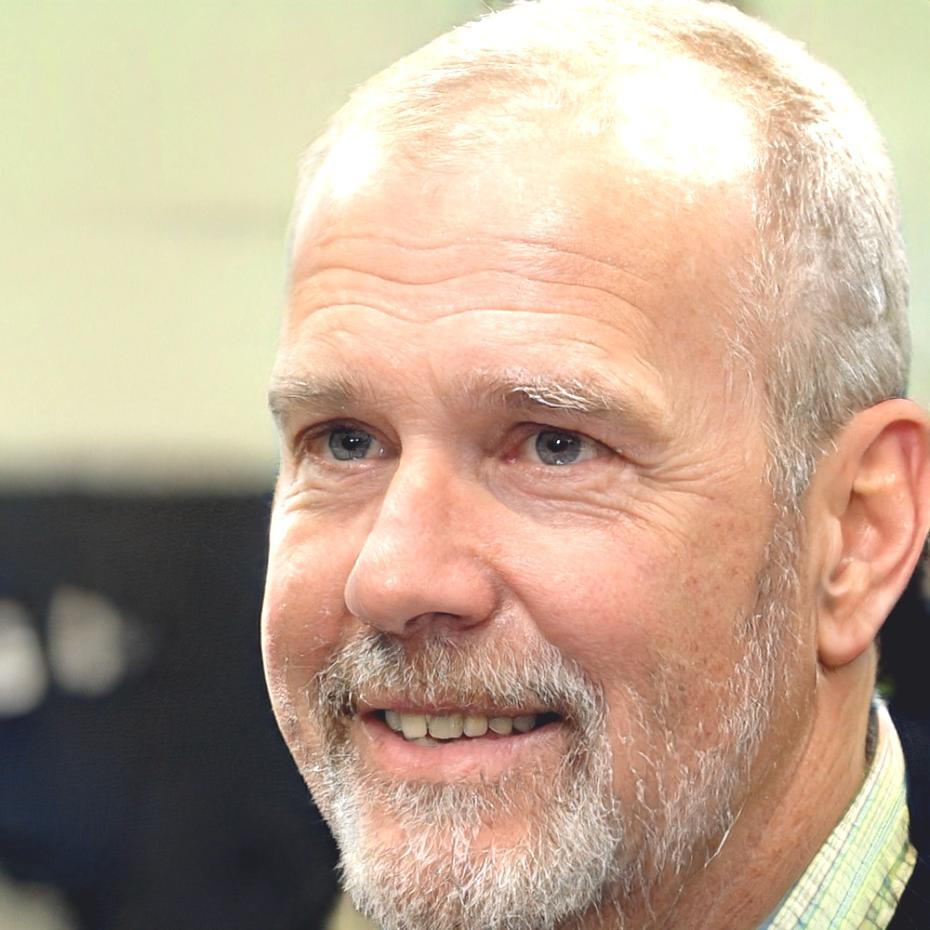

Theodore Bjørklund

Equity Research Specialist

Spent twelve years analyzing Canadian energy and mining sectors at a major Toronto investment firm. Now focuses on teaching practical valuation techniques that actually work in volatile markets.

Maximiliano Verbeck

Financial Analysis Expert

Former portfolio manager with experience across North American markets. Specializes in teaching risk assessment and helping students understand what makes companies genuinely investable.

Dimitrios Koskinen

Research Methodology

Brings fifteen years of institutional research experience, including work with pension funds and endowments. Focuses on systematic approaches to investment analysis and due diligence processes.

Ready to Build Real Research Skills?

Our next cohort begins September 2025 with just 24 spots available. The application process includes a brief interview to ensure this program matches your learning goals.